Jennifer's Blog

How to Decrease Your Spending Without Feeling Like You’re Going on a Diet

I am ashamed to admit that I used to have $135,000 of business and personal debt. I was one of the 50% of Americans who lived beyond their means

Now debt can be useful if you want to buy a house or fund business growth for example. But in my case, my debt did not fund growth and my debt was not an investment in my future. I racked up the debt just to fund my daily expenses.

Occasionally I would make a feeble attempt to pay off my debt by cutting my expenses. But this strategy always failed because I felt deprived; I always felt like I was on an involuntarily spending diet and for me, diets never worked for long. Usually after feeling deprived for a month or two, I would rebound and go on a spending binge, emulating a starving Yak who finally finds sustenance after being stranded in an oasis without food or water.

And then after going around this crazy binge and purge money merry go-round, I finally discovered how to get out of debt without feeling deprived.

Here are the three strategies that I adopted which transformed my relationship to money and brought my net worth out of the red.

Strategy #1: Simplify

I discovered this strategy by accident when I embarked on a mission to have more free time to go to movies and hang out with my friends. I embarked on a journey to simplify my life, not anticipating the drastic affect this would have on my bank account. I went through everything I owned and eliminated everything that didn’t bring me joy. This process sounds crazy simple but evaluating my belongings led me down the rabbit hole of self discovery. I was able to eliminate my storage unit, saving me $$ every month. And then with less stuff, I was able to move into a smaller place that was easier to maintain and actually much nicer than previous houses – and at a fraction of the cost. I also addressed my files and emails and I discovered that

Tip 2: Embrace What Success Means to You (Not What Success Means to Others!)

If you want to be successful doing what you love, take a moment to really define success for yourself; it may not be what you think!

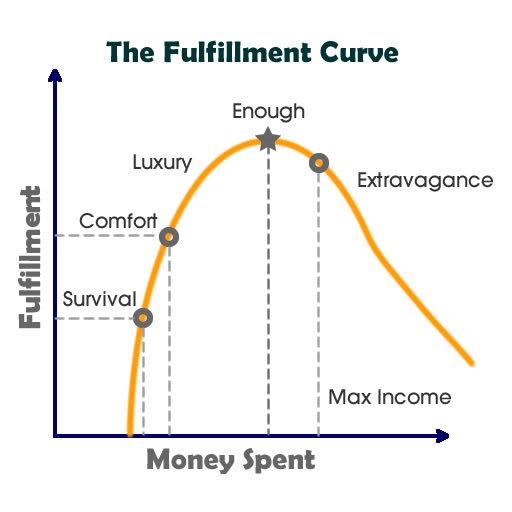

Have you ever heard of the fulfillment curve? One of my favorite concepts from the book Your Money or Your Life, is the idea that spending too much money actually reduces your fulfillment in life. Here is the link to Your Money or Your Life https://www.amazon.com/Your-Money-Life-Transforming-Relationship/dp/0143115766

When I started asking myself, “How much fulfillment do I actually receive from this purchase?” my expenses went down and my fulfillment actually went up. I discovered that success (to me) actually meant greater fulfillment in life and not necessarily a large sum of money in the bank.

Understanding my own definition of success actually created more freedom to do what I love because I wasn’t stymied by the pressure to conform to some arbitrary standard of success.

Strategy #3: Follow Your Heart (and Gut) … ALWAYS!

When embarking on the journey to do business doing what you love, you will be faced by an incredible amount of decisions. Do you need a graphic artist, a website designer, or some help around the office? Who do you work with and what’s the best way to invest in growth?

The biggest mistake I have ever made was NOT listening to my Heart (and gut) when faced with major decisions. For example, if you are looking to hire someone, pay close attention to how you feel around potential hires! If they look good “on paper” but you don’t have a good feeling around them, your innate wisdom is trying to tell you something! I’ve learned the hard way what happens when you don’t follow your heart and gut– utter disaster ensues!

Comment: